🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

(This course is available for immediate delivery) Designed for trading Stocks, ETFs, and Options with a focus on the major stock market indices including the S&P 500 (SPY), File Size: 210.6 MB

TopTradeTools – Tick Trader Bundle

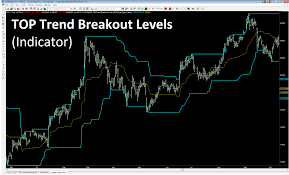

The TOP Tick Trader (ColorBars). This indicator is designed to give professional traders a clear picture of the stock exchange internals via the NYSE $TICK Data, which tracks broad.-Based real-Time stock market buying and trading activity. Finding trades is as simple as finding green bars “Buy” Red bars “Sell Short.”

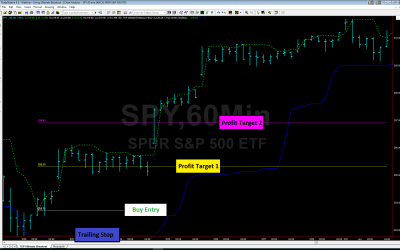

Designed for trading Stocks, ETFs, and Options with a focus on the major stock market indices including the S&P 500 (SPY), Dow Jones Industrial Average (DIA), NASDAQ (QQQ), and the Russell 2000 (IWM). TOP Tick Trader This powerful tool can be used for Day Trading, Swing Trading and strategic Trend Trading. This tool is designed to focus on intraday charts.-minute charts, 5-Minute charts (recommended), 15-minute, 30-minute and 60-Minute charts are just a few examples.

Most professional traders agree that an accurate picture of the stock exchange internals is the best indicator of stock market sentiment. It gives traders a clear view on broad market trends.-Future price movements can be predicted by the stock market’s based buying- and selling activity. The Tick Trader Communicates the live broad-The stock market’s trading activities are based on the actions of buyers or sellers. The stock market can be influenced by subtle changes in buying and selling activity. TOP Tick Trader indicator has been designed to give professional traders a powerful advantage when trading stock market indices like the S&P 500, Dow Jones Industrial Average, NASDAQ, and the Russell 2000. The recommended bar interval for this indicator is the 5-Minute charts for Day Trading, Swing Trading, or even for strategic entry into trend trading.

Easy to Read Shifts In Demand

Prices tend to rise when buyers become more active on the stock market. Prices tend to fall when sellers are more active in the stock exchange. TOP tracks and displays changes in NYSE $TICK market internals. Tick Trader It makes it easy to determine whether the sellers or buyers are stronger. Stock market volatility can lead to broadening.-The TOP is based buying Tick Trader The green color indicates that buyers are more powerful and in control. If the stock market is experiencing broad volatility-Based selling, the TOP Tick Trader Turns red to indicate that sellers are more powerful.

In the QQQ, NASDAQ ETF 5-The minute chart above shows how the TOP is clearly visible. Tick Trader Indicator shows us when buyers have control by making the price bars green, and when sellers have control by making the price bars red. Broadening your detection of broad markets using the powerful NYSE $TICK Market Trading Data-Broad buying or based buying-Based selling in the stock exchange allows us to either jump on the buyer’s side (demand) when price bar are green or jump onto the sellers side (supply), when price bar are red.

Risk Disclaimer: Trading can be risky and past performance does not guarantee future results.

Many traders believe that TOP uses the NYSE $TICK information. Tick Trader, is one the most accurate market sentiment indicators. You must be able to quickly react to market sentiment changes. You can make big moves by being able to quickly react to changes in market sentiment.

Get your instant download TopTradeTools – Tick Trader Bundle

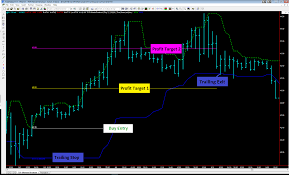

The DIA (Dow Jones Industrial Average ETF) chart shows that the TOP is clearly visible. Tick Trader The chart shows that the control of the market has shifted from sellers to buyers early in the chart. This is evident when the chart shifts from red-colored to green. The DIA prices began to rise from 266 to 273 once buyers took control. Prices are more expensive when there is more demand and buyers are involved.

On the flip side, broadening can be good.-Based selling is identified, the TOP Tick Trader The DIA 5 turns red, alerting us that we need to exit long positions and join the sellers by short selling! You can see the DIA 5-The minute chart below shows prices dropping from 255 to 220 after sellers get involved (red bars).

Trade the S&P 500, Dow Jones, NASDAQ, and Russell 2000 ETFs

The TOP Tick Trader It is a powerful tool for your trading arsenal. Broaden your trading toolbox by tracking the market internals.-Based on the NYSE$TICK, buying power in the stock exchange can be tracked and traded on the side the dominant force – either the buyers (green bars), or the sellers (red bars).

The TOP is available regardless of which stock index you trade. Tick Trader It alerts you when buyers are in charge or sellers are in charge, making it TOP Tick Trader An indicator that you can use to indicate when to sell short or buy the stock market.

Risk Disclaimer: Trading can be risky and past performance does not guarantee future results. Please see the Hypothetical Risk Disclaimer RULE 4.41 at bottom of page.

Back-tested Results

To test the power of TOP Tick TraderWe ran tests to determine if the TOP was working. Tick Trader Over a period of 10 years, we have had profitable results-Year period using 5-min charts The results did not include slippage fees and commissions. We optimized the single input parameter for the S&P 500 over the testing period and the results were positive. We applied the same settings to the tests for the DIA, Dow Jones Industrial Average, QQQ and the IWM (Russell2000). These results were also impressive. Check out the TOP Test Results. Tick Trader Apply to the DIA using 5-Minute price bars with the Lookback setting at 57 bars trading 100 shares DIA ETF.

The trading results graph shows that the TOP is the most popular. Tick Trader Traded the DIA (Dow Jones Industrial Average ETF) consistently profitably for the 10-Year period. Our testing shows that the Lookback input parameter is best at 57 or 231 (better over recent months).

Simple Indicator Parameters

We have created the TOP Tick Trader indicator to be both simple and powerful. The default settings below are our recommended settings. You can change the TOP settings if desired. Tick Trader Longer-term indicator settings-Term or shorter-term market broad-You can modify the Lookback parameter to allow for price-based buying or selling. You can also adjust the color of the price bars to match the chart colors.

Get the TOP Tick Trader Take Advantage Today!

The TOP has the power to benefit both new and experienced traders. Tick Trader Day trading, swing trading, strategic entry trend trading. TOP Tick Trader indicator can be used to trade the S&P 500 (SPY), Dow Jones Industrial Average (DIA), NASDAQ (QQQ), and the Russell 2000 (IWM), including options on these indices. TOP Tick In our testing, traders also performed well with the FAANG stocks. With the TOP, you can now see when the sellers and buyers are stronger. Tick Trader indicator. TOP Professional Grade Tick Trader Take advantage of this offer now. Click the button below and get the TOP Tick Trader Get your indicator today!

Here’s What You Will Get in TopTradeTools – Tick Trader Bundle

Course Features

- Lecture 1

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 135

- Assessments Yes

- 1 Section

- 1 Lesson

- Lifetime

- Purchased: TopTradeTools - Tick Trader Bundle1