🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

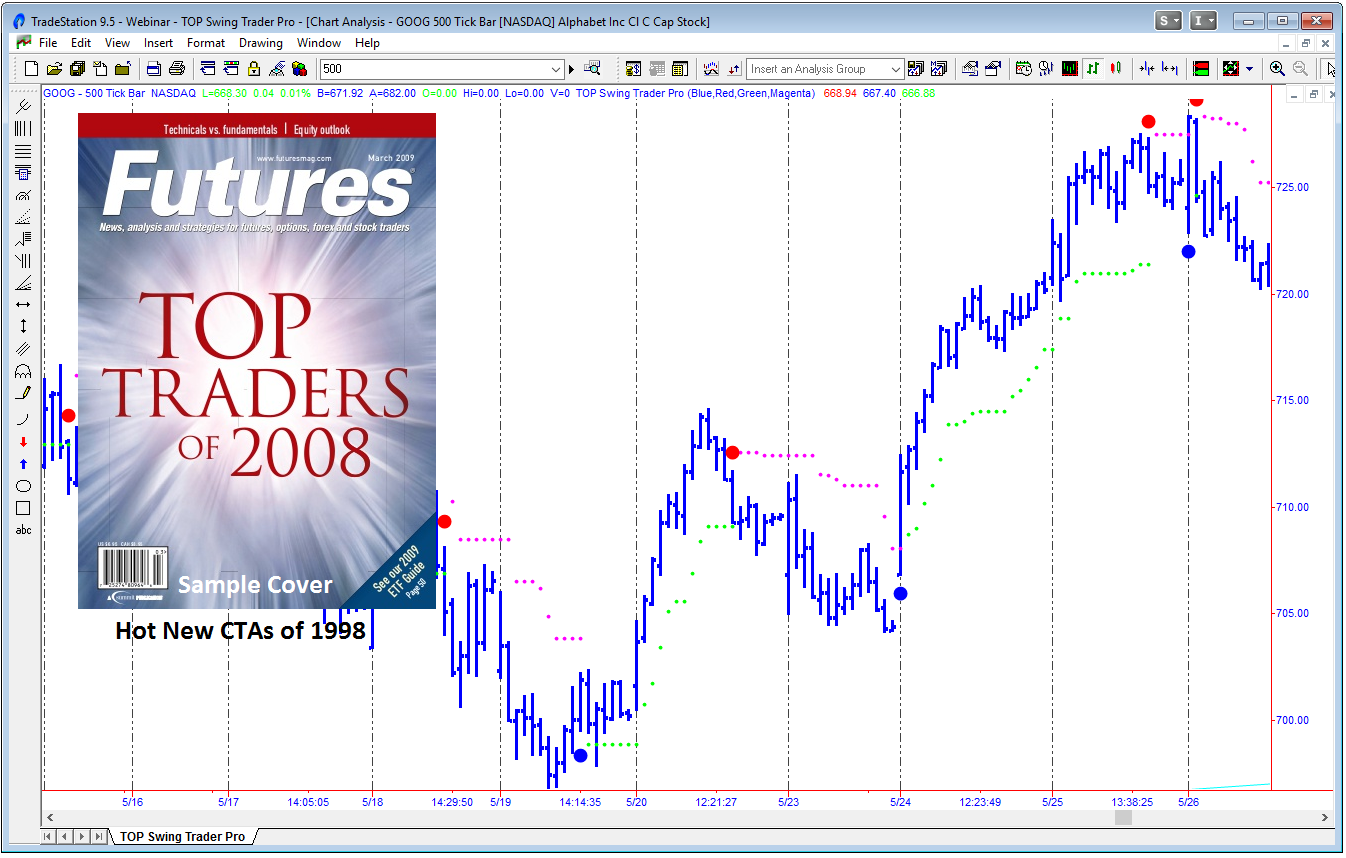

The Swing Trader Pro Uses an enhanced version a hedge fund trading strategy that was used to win the Hot New CTAs award in Futures Magazine.

For stocks, options and futures.

TopTradeTools – Swing Trader Pro

TOP Swing Trader Pro

with IntelliStep™ Trailing Stop Technology

Strategy

The Swing Trader Pro Uses an enhanced version a hedge fund trading strategy that was used to win the Hot New CTAs award in Futures Magazine.

For stocks, options and futures.

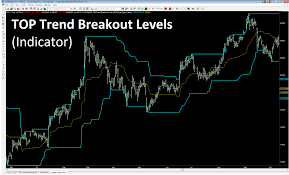

You can now use an enhanced version the same trading strategy we used to win Hot, New CTAs category in Futures Magazine. The Swing Trader Pro This strategy is designed to profit from significant price movements in any market, stocks, options, futures and forex. We recommend that you take the time to learn how to apply this powerful strategy to the market.

Swing Trader Pro Based on actual Hedge Fund Strategy

We focused on a core set of robust trading strategies when we launched our first hedge fund over ten years ago.-Tested algorithms. We wanted trading strategies that would capture the profits from significant price moves in our markets. This strategy was one of our core strategies and we were recognized by Futures Magazine as a Hot New CTA/Hedge Fund.

We made a great thing even better! We worked hard to make the Swing Trader Pro We improved on the original strategy that won us recognition in Futures Magazine to make it better than the original. Our new CBR was incorporated into our improvements Pro™ and IntelliStep™ Trailing Stop Technology.

Easy to follow signals for trading!

The Swing Trader Pro It makes it easy to follow powerful signals from hedge funds. No need to set complicated parameter settings. All you have to do is choose the colors of your Signal Dots and the colors of your IntelliStep™ Dots. Choose four colors and let Swing Trader Pro Do the rest!

Follow these simple steps to take the guesswork out of trading analysis. Swing Trader Pro Dots. Trading signals don’t not get much easier than this. The Swing Trader Pro It is designed to capture significant price movements in any market. Like any strategy, we recommend applying the strategy strategically. Swing Trader Pro You can identify high-probability trade setups and send them to the markets (See How We Recommend using). Swing Trader Pro).

Sign Dots right on your Chart

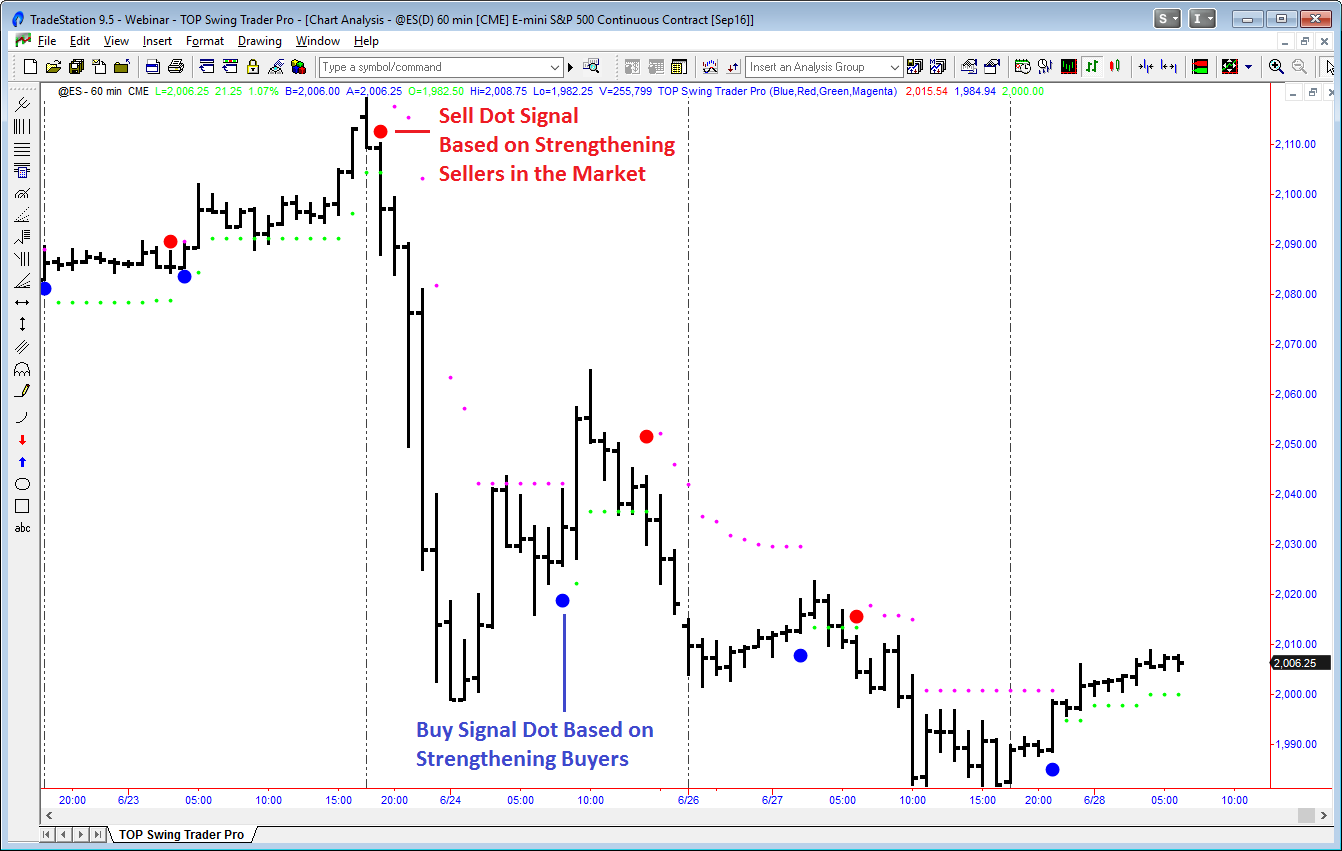

The Swing Trader Pro You can plot easily-read Buy and Sell Dots directly on your chart!

● Swing Trader Pro Buy Dot

● Swing Trader Pro Sell Dot

Each time or price bar is completed, the Swing Trader Pro To determine if a trading signal should generated, it will be used to measure the strength and demand in your market. A Buy Dot will appear under the price bar if market buying strength meets the signal quality criterion. If this occurs, then you can consider taking either a Buy Position or a Long Position at the close of each price bar.

If the market selling power meets the signal strength criteria, then a Sell Dot will appear above the price bar. The price bar will close and you can take a Sell Position (Short Position).

Trades should be free from negative emotions

Over the years, traders have been derailled more by fear and greed than any other factor. Professional traders will tell you to control your emotions if you want to make consistent profits in the markets.

The Swing Trader Pro This analyzes the strength and direction of shifts in supply or demand in a market. It only generates a signal dots when these shifts meet a certain criterion. This allows you to ignore fear and greed and concentrate on the important internals of the market like supply and demand.

Buy Now

No Complex Settings

When it comes to development, one of our top priorities is Swing Trader Pro a simplified set of parameter settings to make it easier for you to use this trading indicator.

You don’t have to worry about having the wrong settings for a parameter anymore, and you don’t have to invest large amounts of time understanding what each parameter is designed to do. You only need to choose the color for your signal dots, and your trailing stop dots.

TOP Swing Trader Pro

Trade Station, Think or swim, Ninja Indicator Trader, Sierra Charts, eSignal

Register Now

We recommend using Swing Trader Pro

Swing Trader Pro This is designed to profit from market price movements in any direction. As any professional trader knows, markets may occasionally experience choppy or sideways conditions. Trading in these market conditions is not advised as it can increase the chances of losing trades and false signals. Trading strategies that are vulnerable to market volatility can lose money. We recommend avoiding them.

Instead, we recommend using the Swing Trader Protomarkets are used to identify high probability trade setups. You can benefit from learning proven trade strategies if you’re new to trading. We believe that both novice traders and experienced professionals can learn how to identify powerful trade setups in real-time. Once you have mastered the art of recognizing trade setups that have been proven successful, you will want to follow these steps. Swing Trader Pro Signal dots are placed in the direction that each trade setup is heading. It’s that easy and it’s a powerful approach to trading.

Sometimes, a signal can be generated after a large price movement in either the up or down direction. These signals are best ignored as the market has already realized the signal’s trade potential. This situation is often avoided by tick charts.

We believe that the power of the combined is greater than the sum of its parts. Swing Trader Pro With time-One of the most powerful ways to trade in the markets is with proven trade setups. The goal is to put the odds on your side to give you an edge when trading the markets….Other products available TopTradeTools Right now!

Real world trading

We want you to be realistic about trading, unlike some websites. Trading is a high-risk activity and you cannot guarantee that you will make a million bucks using the website. Swing Trader Pro. We all know that some people can crack the code and make huge amounts of money in the markets. There are no shortcuts. Trades that are successful require hard work and a disciplined approach to trading. They also have the right trading tools to give an edge.

Are you certain to make money on every trade you make? Swing Trader Pro? No. No. Swing Trader Pro Strategically with proven trade setups to make a profit in the markets We believe the answer is a confident “Yes!” You must be patient to learn proven trade strategies. It is not difficult but it takes time.

The Swing Trader Pro This is a result of system technology that we used to manage real customer accounts with our hedge fund. It was not easy, but it took discipline as well as hard work.

We believe that anyone can be a successful trader if they put in the effort and work hard. The following are our top tips. Swing Trader Pro was developed to be a powerful addition to any trader’s toolbox.

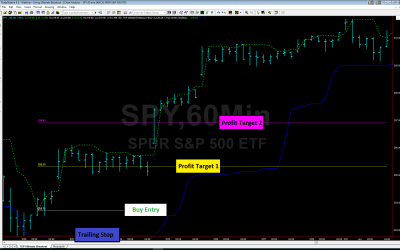

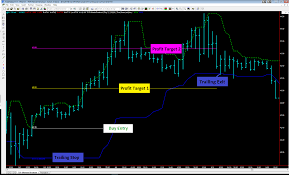

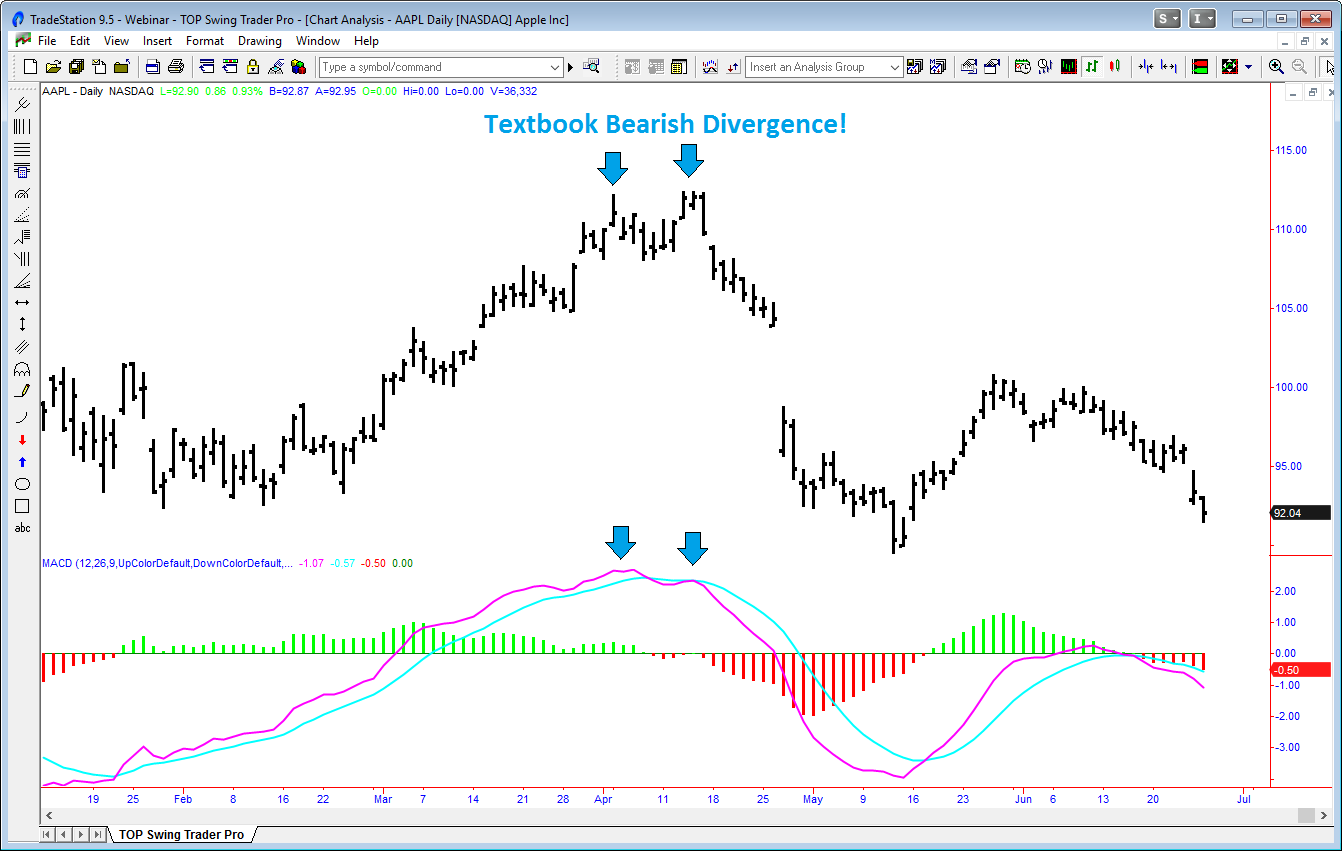

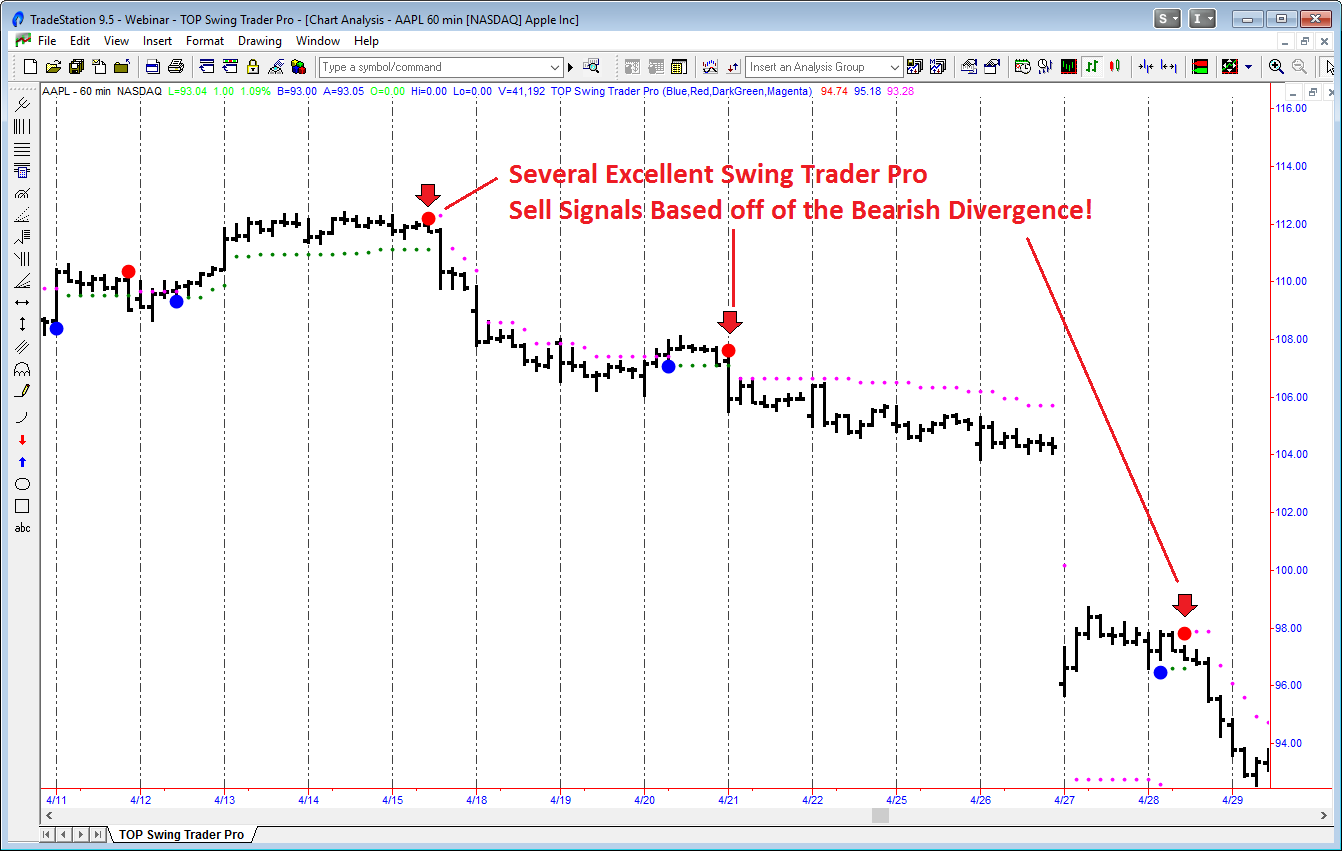

Short trading example for Apple (AAPL).

The first step is to identify the daily bearish divergence. Once you have done that, you can then take sell signals from the Swing Trader Pro You can use the 60-minute charts to show a shorter time frame.

Other products available TopTradeTools Right now!

The best way to trade any market is by finding trade setups over a longer timeframe, then drilling down to a shorter timeframe to get your trading signals. The chart below shows several outstanding trading signals. Swing Trader Pro Sell signals based on the daily bearish divergence trade setup shown in the AAPL chart.

Remember, we want to only take trading signals in the direction that a trade setup is for the following five to ten bar or in this case, for the next seven days (based on the daily AAPL chart). Once we see the potential of a trade set-up, we stop taking them. Swing Trader Prosignals. Learn about setup shelf life.

However, not all trades result in making money. You will lose trades. However, we believe that combining the Swing Trader Pro You can get very good results in the markets with proven trade setups. After the daily bearish setup, the five trades on the above 60-minute chart of AAPL earned $15.50 per share. This includes the fifth trade, which was also a loser. Make sure you read the hypothetical disclosure statement at bottom.

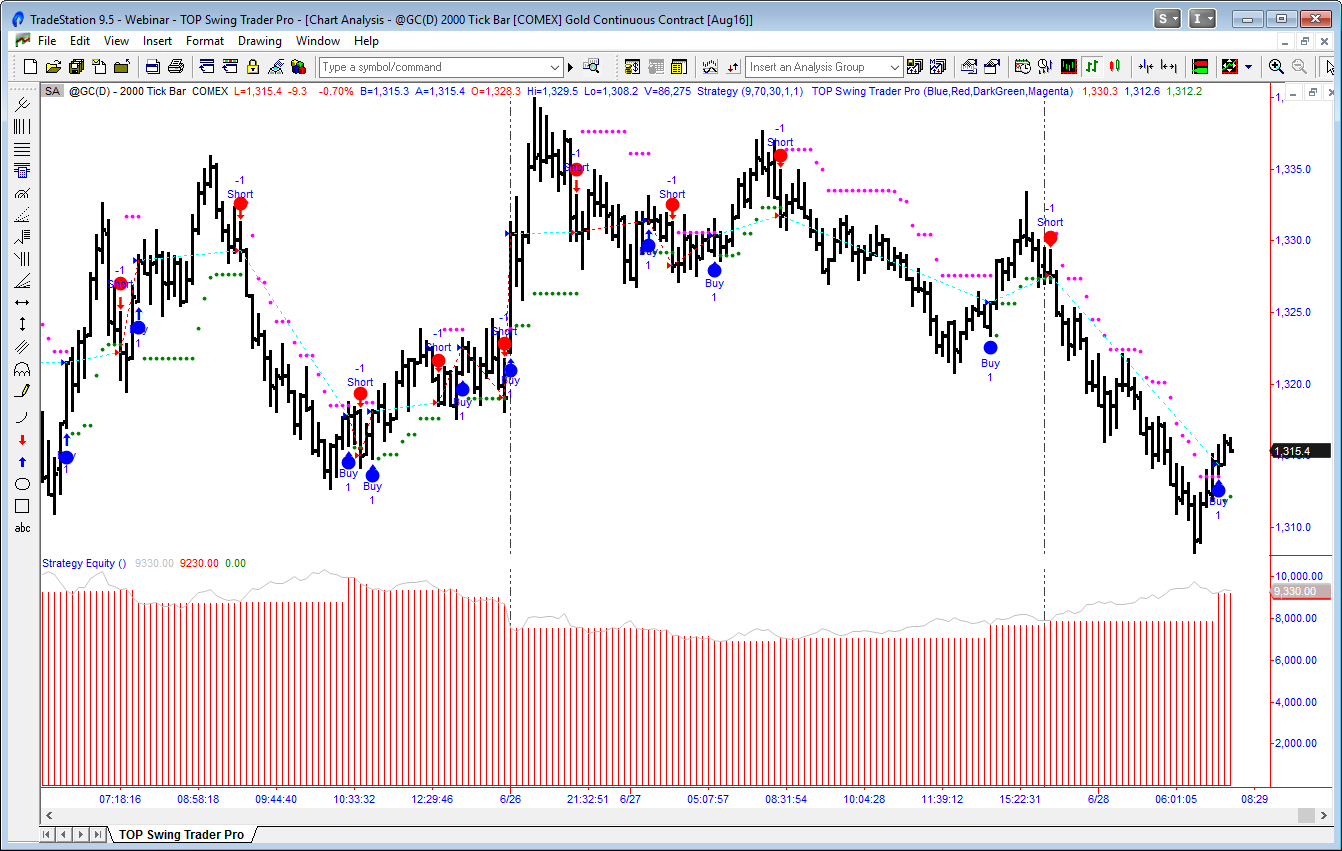

Gold Futures (GC). “Brexit” Trading example

Everyone knew that there would be extreme volatility in the stock markets and in gold during the Brexit vote, when the UK was voting to leave the EU. These events are great opportunities to make huge money from high volatility conditions. We could have also considered trading Gold futures to the Brexit event.

If we take all of the trades from June 23 to current price levels at the time of writing, it would have been $2,840 per contract. That assumes you take both sell and buy trades. In reality, a trader would only have taken the buy signals after gold soared, which would have produced even greater profits. Make sure you read the hypothetical disclosure statement at bottom.

Below are several examples of how we can do this. Swing Trader Pro You can use it to make money in the market. There are many other examples of how this powerful trading instrument can be used in order to make money on the markets. We want to make sure you understand that losing trades are possible.

It is important to be aware of the limitations of hypothetical examples. Make sure you read the hypothetical disclosure statement at bottom. There is always a risk of losing when trading in the market. Past performance is not an indication of future results. Please take the time and understand the risks involved in trading in the markets.

Course Features

- Lecture 0

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Students 121

- Assessments Yes