🌟 New Year Offer 🌟

Celebrate 2025 with 30% OFF on all products! Use code: NEWYEAR2025. Hurry, offer ends soon!

Quantified Strategies 3 Short Selling Strategies Trading Strategy Bundles

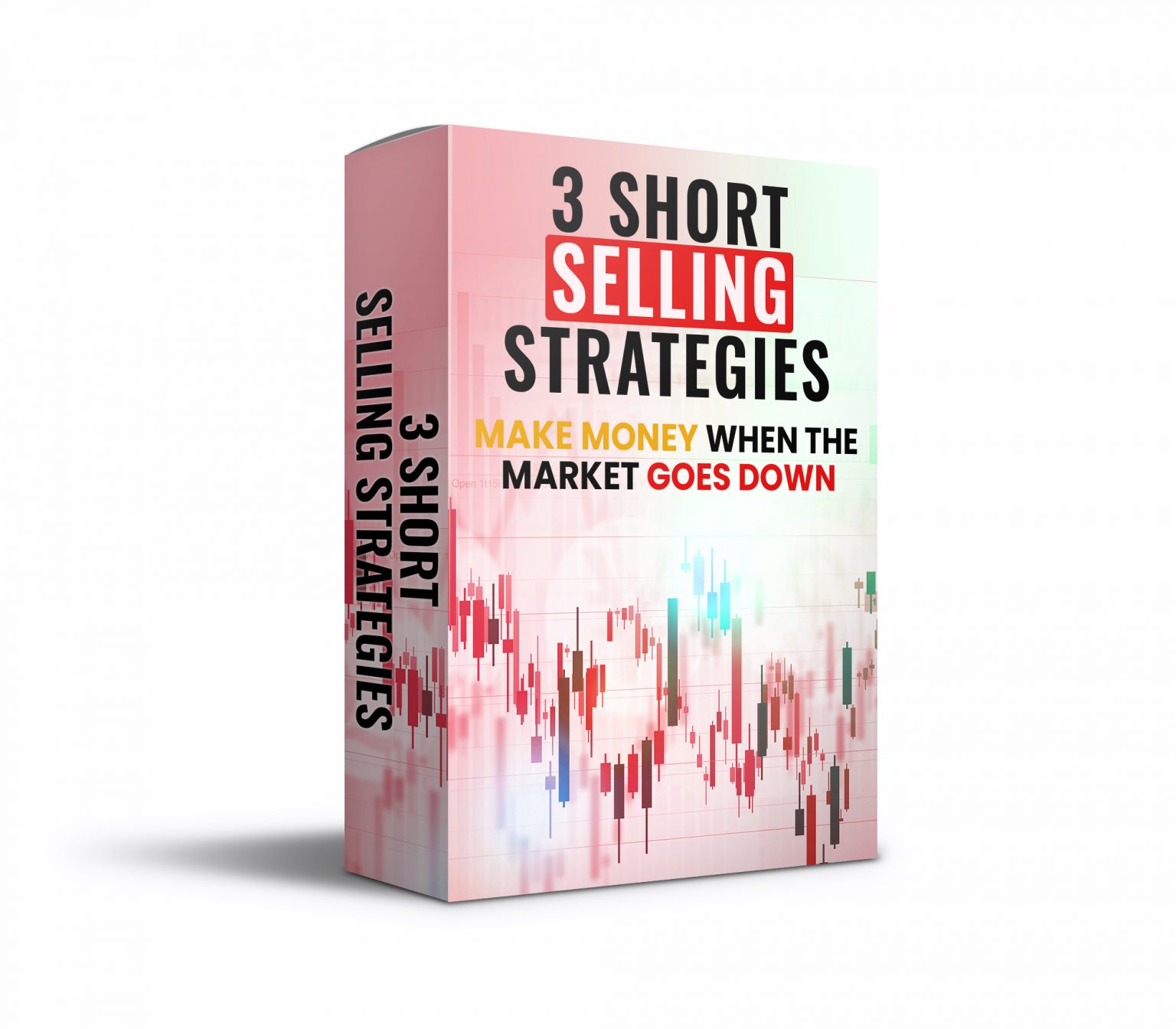

Quantified Strategies – 3 Short Selling Strategies – Trading Strategy Bundles, This short-selling strategy bundle consists of three short strategies.

3 Short Selling Strategies (Trading

Strategy Bundles)

This course is available and delivery within a few hours!

File Size: 207 KB

Quantified Strategies – 3 Short Selling Strategies – Trading Strategy Bundles

This short-selling strategy bundle consists of three short strategies. The idea and logic work in a variety of assets, not only the three different below. Entries are on the close or the next open (and the same for exits).

The bundle comes with code for Amibroker, TradeStation/EasyLanguage, TradingView/Pine Script, and trading rules in plain English.

None of the strategies are published on the website earlier and all strategies work on a variety of ETFs and futures contracts (and not necessarily on the backtested instruments below).

Please check out our other Strategy Bundles.

Table of contents:

Short strategy 1

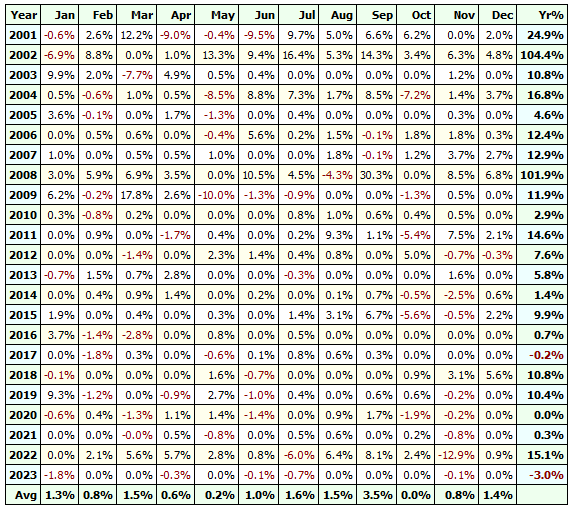

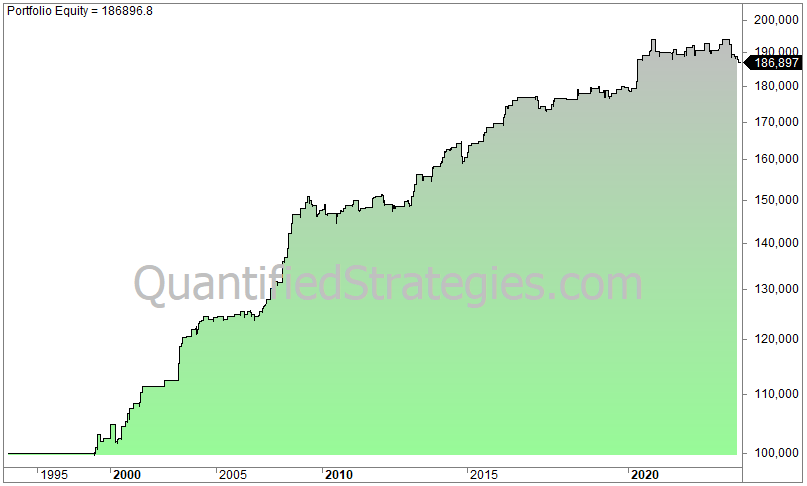

The backtest below is done on S&P 500 (SPY or @ES):

Strategy and performance metrics:

- #trades: 125

- Average gain per trade: 0.72%

- CAGR: 2.9%

- Time spent in the market: 7%

- Max drawdown: 11%

- Risk-adjusted CAGR: 40%

- Win rate: 66%

- Max consecutive losers: 7

- Max consecutive winners: 16

- Profit factor: 2.1

- Sharpe Ratio: 1.7

Short strategy 2

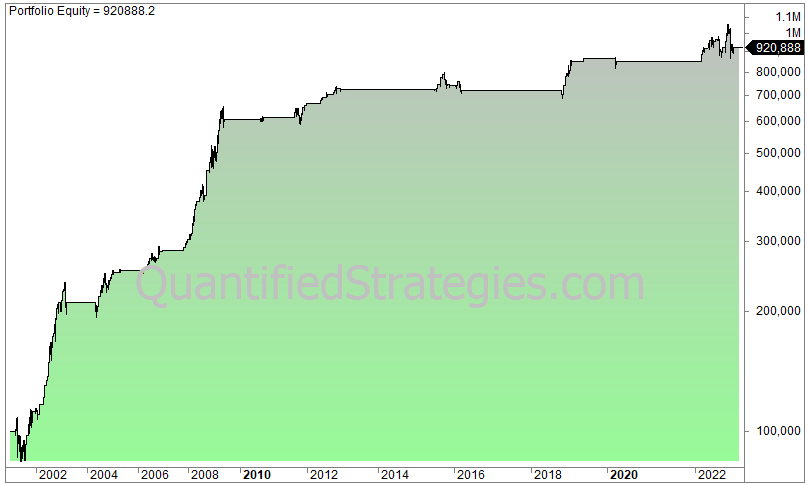

The backtest below is done on XLP (consumer staple ETF):

Strategy and performance metrics:

- #trades: 220

- Average gain per trade: 0.3%

- CAGR: 5.3%

- Time spent in the market: 5%

- Max drawdown: 4%

- Risk-adjusted CAGR: 38%

- Win rate: 71%

- Max consecutive losers: 7

- Max consecutive winners: 20

- Profit factor: 2.4

- Sharpe Ratio: 2.1

Short strategy 3

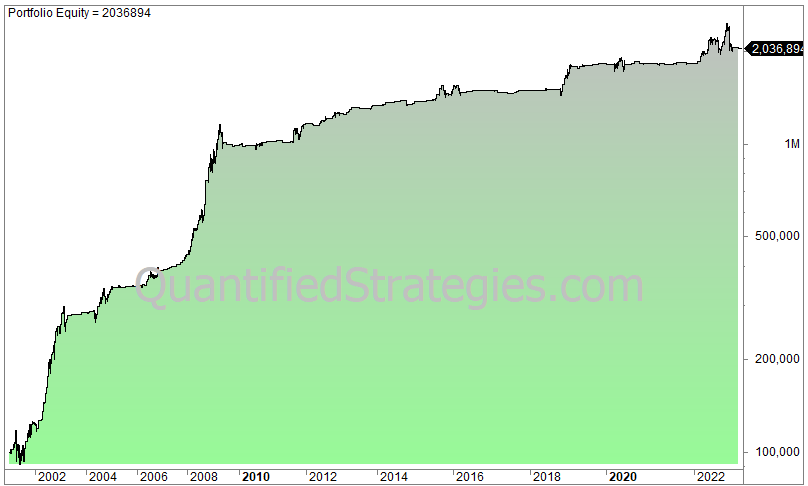

The backtest below is done on SMH (semiconductor ETF):

Strategy and performance metrics:

- #trades: 188

- Average gain per trade: 1.24%

- CAGR: 10.1%

- Time spent in the market: 11%

- Max drawdown: 22%

- Risk-adjusted CAGR: 91%

- Win rate: 71%

- Max consecutive losers: 4

- Max consecutive winners: 19

- Profit factor: 2.1

- Sharpe Ratio: 2.1

All 3 short strategies combined

If we combine all 3 short strategies and take max one position at a time, we get the following equity curve:

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 105

- Assessments Yes