🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

Stop speculating and start following the 21st annual “blue-line” roadmap that has accurately predicted bull markets and recession timings for decades.

Larry Williams – Annual Forecast Report 2026

- My futures market analysis and predictions for the upcoming year in a single PDF report

- Individual forecasts for the major indexes in Australia, Japan, China, Germany, Russia, Canada, Brazil, Korea, Great Britain, India, Hong Kong, Taiwan, and Italy

- My personal view of where US Stocks, Bonds, Metals, Currencies, Grains, Softs—all the major futures markets—are headed in 2026

- Use my Cycle Forecast Charts as your roadmaps for over 50 stocks & all active futures markets

- Our 21st Annual Edition

- Trusted By Traders and Investors in 79 Countries

Announcing Forecast 2026 Report …

Is it the end? Will stocks crash in 2026?

You don’t have to wait to find out.

I am projecting a major stock market BUYING OPPORTUNITY in 2026.

- Those who recognize it could build fortunes.

- Those who ignore it may face painful losses.

This isn’t speculation—it’s backed by proof. My forecasts for 2023, 2024, and 2025 were published in advance and have already demonstrated the power of stock market cycles.

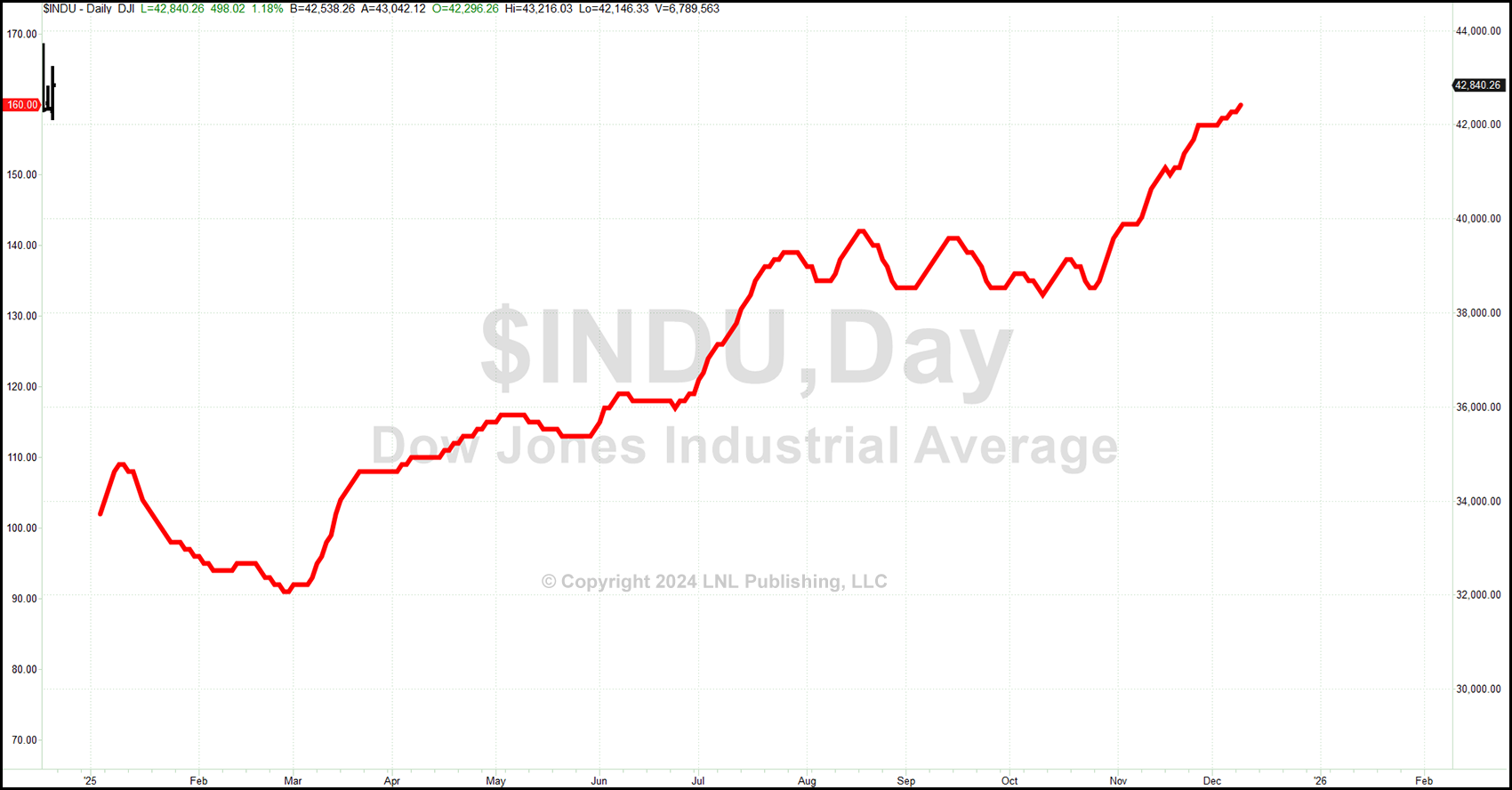

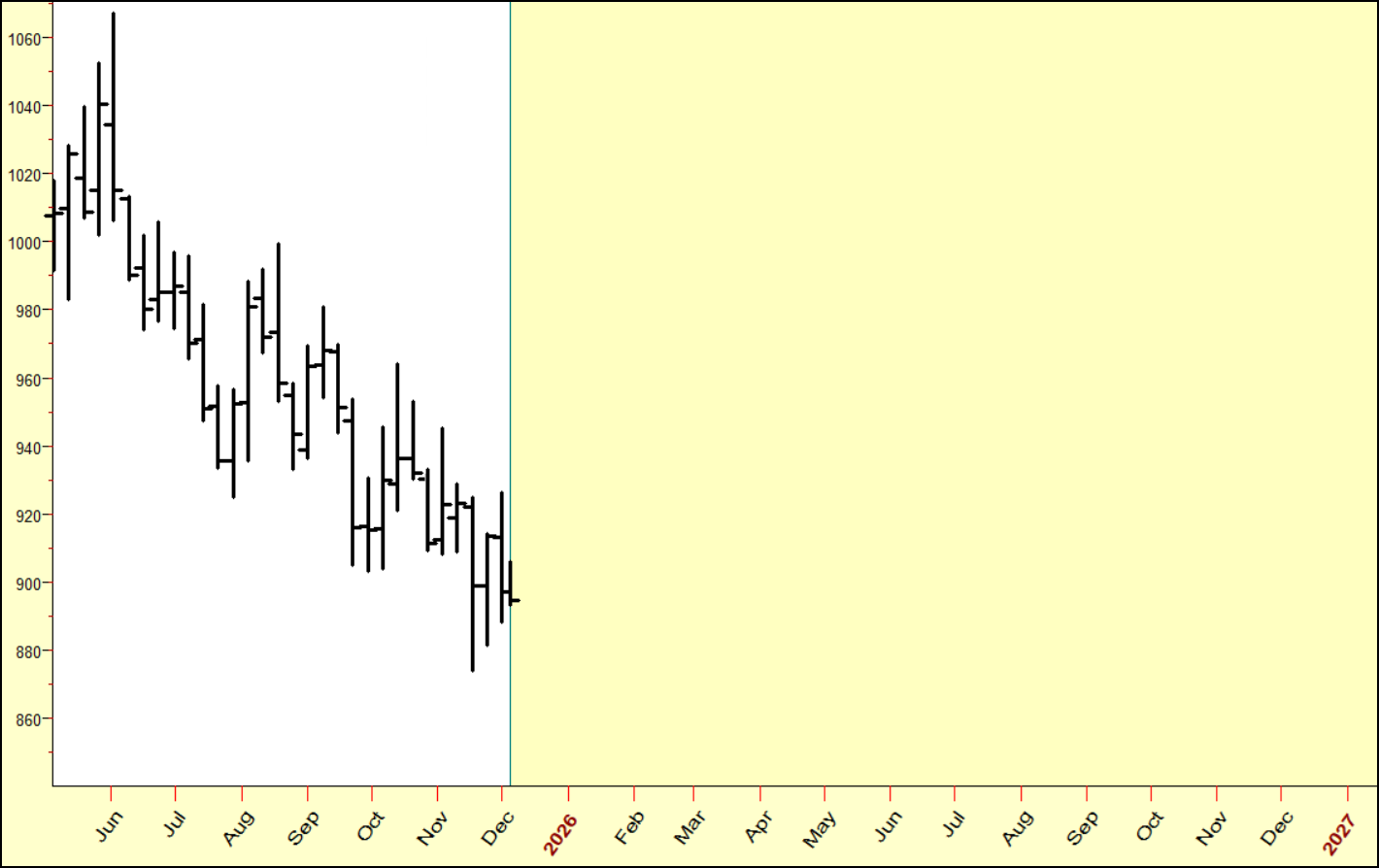

Figure 1: 2025 Natural Cycle Forecast DJIA

(Chart 13 in Forecast 2025 Report)

Figure 1 was my natural cycle forecast for 2025 from page 16 of my report. Helpful?

Was this just luck? Perhaps, so why not look at my forecast for 2024 and 2023 shown here with what the Dow (DJIA) did vs the forecast.

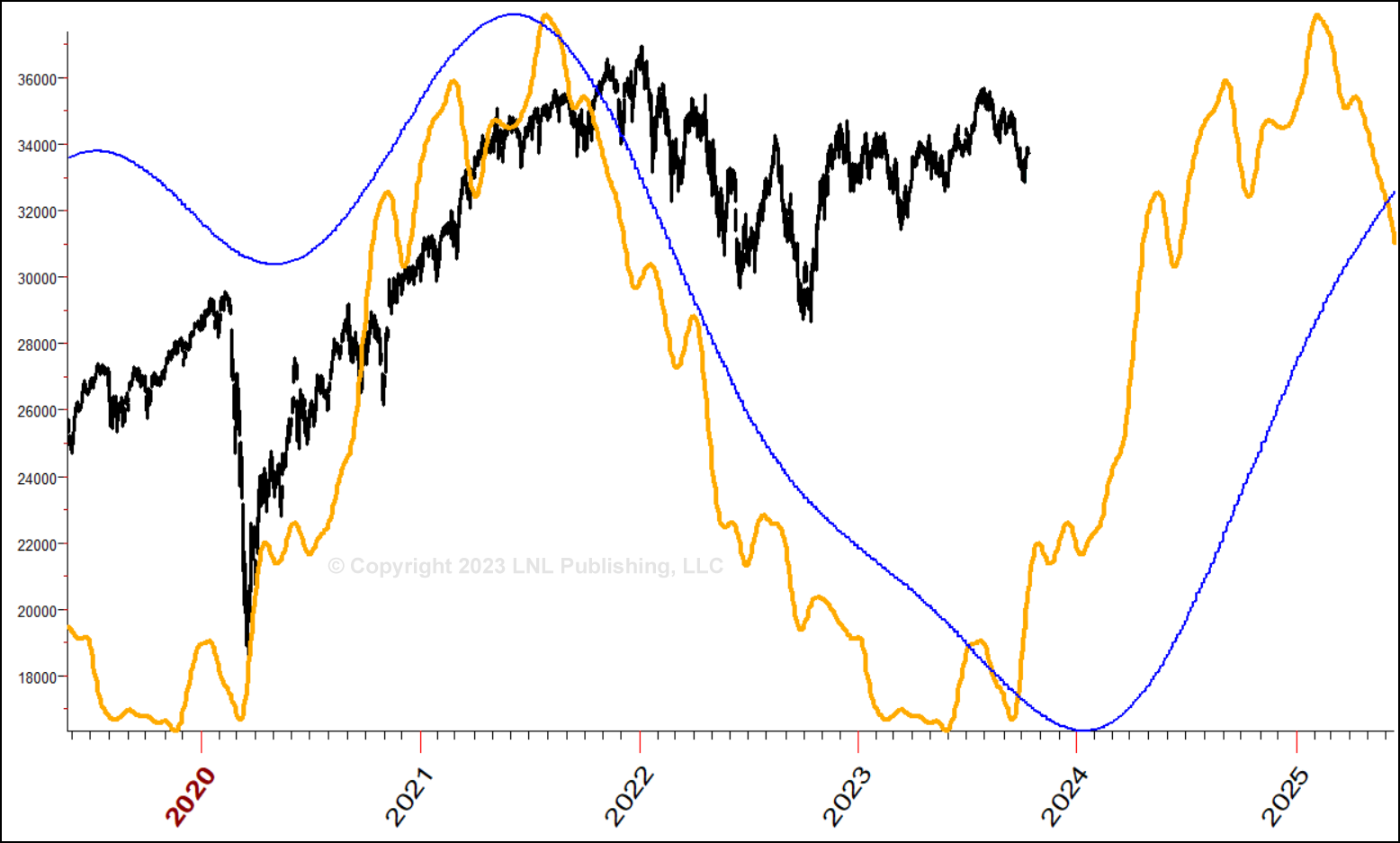

Figure 2: 2024 Cycle Projection with Price

(Chart 17 Forecast 2025 Report)

Figure 2 was my cycle forecast for 2024 in blue and gold with how it actually came out.

Figure 3: 2023 Natural Cycle Forecast

(Chart 12 in Forecast 2025 Report)

Exclusive Market Forecasts

Figure 3 was my natural cycle forecast for 2023 in blue—side by side with how it actually played out.

I’ve spent a lifetime learning how to forecast the future of markets starting in 1962.There were false starts, dead ends, and plenty of lessons along the way. But over time, I uncovered the cycles and patterns that truly drive markets. What you see here is proof: forecasting isn’t magic, it isn’t perfect—but it is a reliable roadmap you can follow.

- Bull Market: We forecasted it—and we got a great one.

- Housing Prices: Declines, exactly as expected, despite the doomsayers.

- Recession: Many predicted one. We said “no way.” We were right.

- Inflation: A bounce, but no change in long-term direction.

- Employment: No serious decline expected in 2025—and none occurred.

Inside the 2026 Forecast Report

You will get:

- Forecasts for all major stock market averages

- Inflation outlook

- Interest rates projection

- Recession probabilities

- Real Estate Trends

- Cycle forecasts for all actively traded commodities

- Cycle forecasts for 60 actively traded stocks (see list below)

Proof That It Works …

Some say forecasting is just “hooey.” But not Jim Cramer—he’s featured my forecasts for years on Mad Money. On StockCharts.com hundreds of thousands have seen my work. As well as the countless viewers on YouTube who’ve watched my forecasts play out.

Now, for the first time, you can gain exclusive personal access to my 2026 forecasts—insights that will not be revealed to the public.

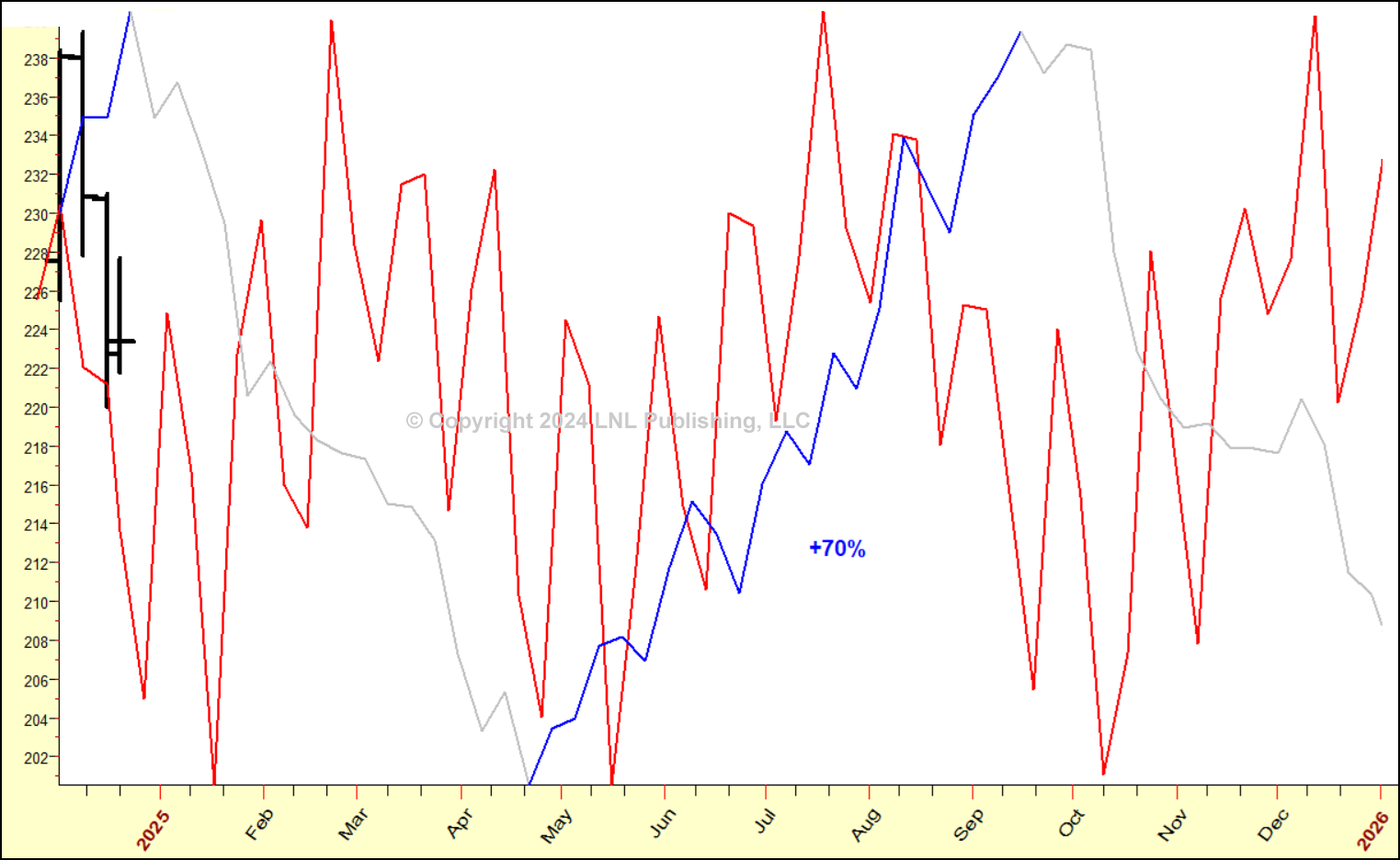

Figure 4: 2025 International Business Machines IBM

(Chart 124 in Forecast 2025 Report)

Figure 4 is 2025’s forecast for IBM. Quick, get your charts to see how this actually panned-out.

Free Forecast! See For Yourself.

I’m sharing two charts with you so you can determine which one helps you the most.The first is the view 99.9% of traders have for COSTCO for 2026. Take a look. Is it helpful?

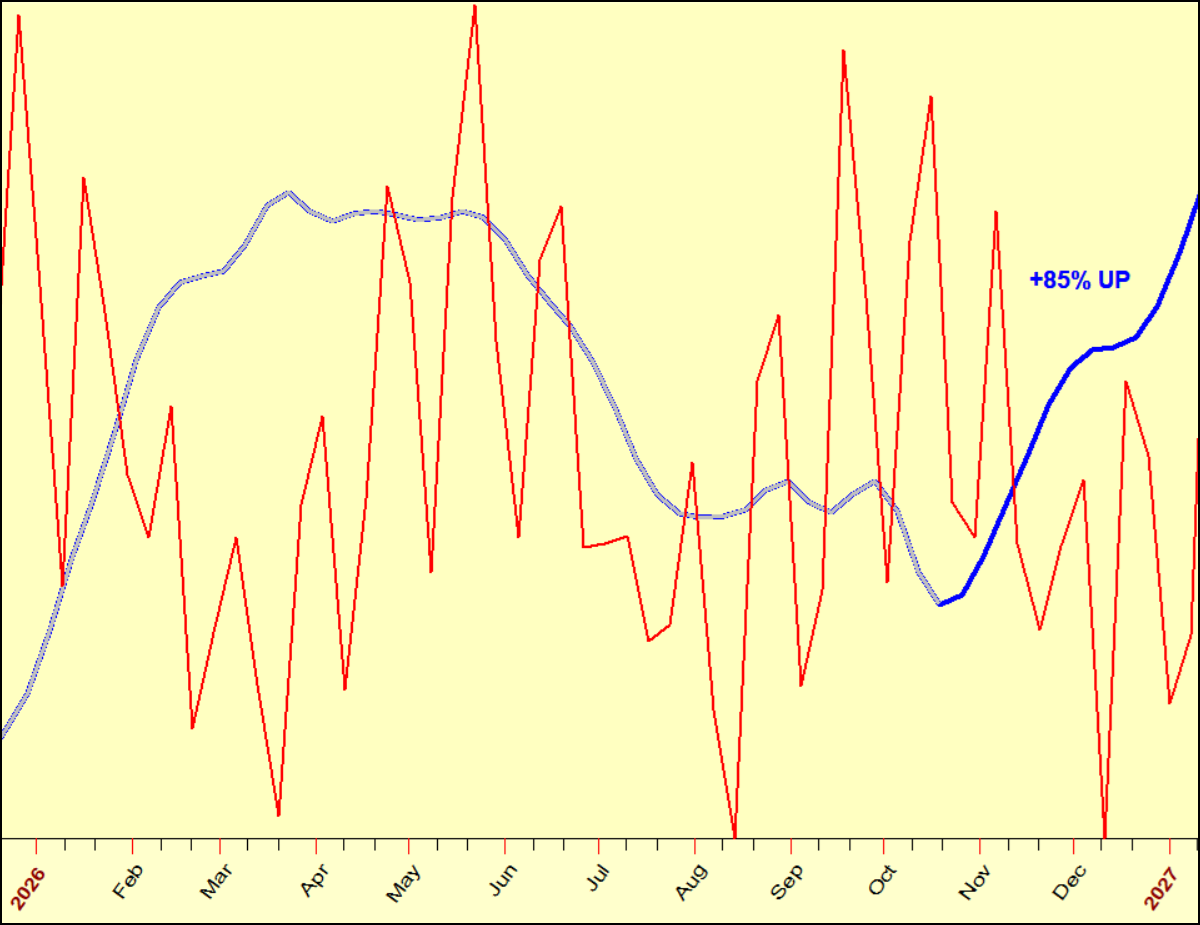

Figure 5: 2026 COST Forecast Most Traders See

Then look at the next chart, my 2026 forecast for Costco (COST). This view—advanced knowledge—for trading and investing can be yours for 2026.

Figure 6: My 2026 COST Forecast

In my Forecast 2026 Report you will see forecasts just like the Costco example in Figure 6. The intermediate-term cycles are shown in red, and long-term cycles are in blue. These roadmaps reveal major market turns well in advance. My report has this level of detail for all the actively traded futures, stock indexes, currencies, Bitcoin, and 60 US stocks (listed below).

These forecasts are un-hedged, direct, and simple to follow. The blue line highlights the most reliable periods for rallies and declines. Historically, Costco has rallied 85% of the time during this long-term cycle wave, giving you clear insight that can dramatically improves your investment focus and success.

Some of you may recall, in November of 2023 I used my cycle analysis to successfully forecast a buy point in COST live on Mad Money, 300 points below the market.

The Blue Line: A 75% Advantage

I reviewed last year’s forecasts, well over 70 markets. 76% of the major moves aligned with the blue-line timing. That’s an extraordinary advantage.

Yes. You can know what’s coming.

The 2026 Forecast Report is over 100 pages, yet every projection is concise and actionable. You will see my forward-looking analysis for the S& P E-minis, DJIA, bonds, precious metals, grains, softs, all major currencies, global stock markets, and 60 of the most active individual stocks.

When the Next Recession Begins

Early in 2025, major firms—Morgan Stanley, Bank of America, Lee Cooperman, Rich Dad/Poor Dad’s author, and many others—predicted a recession or a bear market. Two of the largest research houses even called for a 30% decline.

My readers knew better. I showed exactly why the timing wasn’t right.

A recession is coming—of that I am certain. But the key is when.

You will be told the exact timing and the underlying reason for this call. Use it for your business, your investments, and your personal financial protection. This one insight alone is worth thousands.

What Else You Will Learn

- How to Properly Use Cycles

- Many forecasters misuse cycles and blow up because they don’t understand the nuances. This year I explain their mistakes—and show you the correct way to use cycles for real-world trading and investing.

- Inflation: Is the Next Wave About to Begin?

- In 2022 I nailed the inflation peak. Last year I projected a rebound, which we are now seeing. So what happens next?

- Cycles point to another rise—soon. You’ll see exactly when I expect inflation to return and how it historically interacts with stock prices (in a way the “experts” never mention).

- The Key Economic Indicator No One Talks About

- Around the 15th of each month the Fed releases a little-known indicator that has always peaked at the start of recessions—data going back to 1920.

- You’ll see its impact on stocks and the powerful cycle behind it, which has an incredible record of calling major bull and bear markets.

- Real Estate Update

- Last year I correctly forecast falling real-estate prices and a buyer’s market. The 2026 outlook shows a meaningful shift you need to be prepared for.

- The Best Seasonal Trades—Plus Three Exceptional Setups

- You will learn the most profitable days of the week, month, and year to trade Gold, Bonds, and the S&P Emini—a treasure trove of high-value trades on its own.

- Plus, three specific, easy-to-follow setups:

-

- Gold: 78 trades, over $54,000 total profits

-

- Bonds: 79 trades, 77% winners, over $25,000 total profits

-

- S&P E-Mini: 176 trades, 80%+ winners, over $90,000 total profits

Two Incredible Buy Signals—Will We Get Another in 2026?

My long-term Panic Indicator flashed major buy signals on March 20, 2020 and June 17, 2022—exactly when most were telling you to sell. Both turned out to be outstanding buying opportunities.

If another major buy—or sell—signal appears in 2026, subscribers will be notified free of charge. Consider it your built-in insurance policy.

Why Pay Over $1,000?

Many annual forecasts cost $1,000 for just one market. Some charge $500 for vague commentary. One so-called forecaster is asking $100 per market.

This report includes over 100 market forecasts—but you won’t pay anywhere near $10,000.

We’re holding the price at only $199 until January 15th to give you the highest-value forecast at the best possible price. The report is $249 after January 15th, still a great value.

Important: There Is a Cut-Off

In addition to extensive research, I actively trade the markets—so I don’t have time to sell this report all year. I want to get back to trading.

Sale ends January 31, 2026 at Noon Eastern.

Not Pacific.

Not midnight.

Noon.

After that, purchases are closed. Every year, people try to buy after the cut-off—and every year, we turn them away.

Be Ready for the Future

Click below and in minutes you’ll have the full report—and the clarity to navigate 2026 with confidence.

Good Luck and Good Trading,

— Larry Williams

Course Features

- Lecture 0

- Quiz 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 71

- Assessments Yes