🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

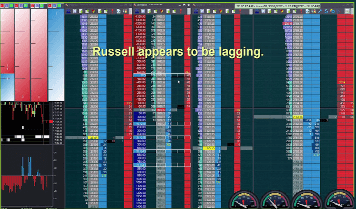

I am often asked what I look for when I trade and how can I reduce my risk. First, you must understand the Market Structure as well as the opportunity that may be opening up.

Kam Dhadwar – Trade Execution & Trade Management |

Course Features

- Lecture 0

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Students 168

- Assessments Yes