🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

Project Finance Modeling for Renewable Energy course will give you the skills to develop and analyze project finance models for wind and solar projects. The course covers essential topics including debt sizing and funding, wind and solar project operations, and investment returns, and will provide you with a robust financial modeling skillset for analysis of renewable projects in the most sophisticated environments.

Gregory Ahuy & Bekzod Kasimov – Project Finance Modeling Premium Package

This premium package contains 6 project finance, M&A modeling and accounting courses:

– Project Finance Modeling for Renewable Energy

– Tax Equity Flip Modeling

– M&A Modeling for Renewable Energy

– Financial Modeling For Mining

– Project Finance Modeling For Infrastructure

– Accounting for Financial Modeling

Project Finance Modeling for Renewable Energy

Project Finance Modeling for Renewable Energy course will give you the skills to develop and analyze project finance models for wind and solar projects. The course covers essential topics including debt sizing and funding, wind and solar project operations, and investment returns, and will provide you with a robust financial modeling skillset for analysis of renewable projects in the most sophisticated environments.

15.5 hours on-demand videos

178 downloadable resources

Advanced Financial Modeling for Renewable Energy (Tax Equity Flip Structure)

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project’s debt capacity, valuation and financial feasibility depend on expected future cash flows generated by the project and a financial model is built to analyze this. In the tax equity flip structures, there is additional complexity related to the IRS tax rules that have to be reflected in the financial model. On top of that, we have to be able to correctly size the back-leverage debt in the downside scenario, taking into account and reflecting the tax equity’s seniority in the financial model.

14.5 hours on-demand videos

185 downloadable resources

Financial Modeling for Renewable Energy M&A

Financial Modeling for Renewable Energy M&A course will give you the skills to develop and analyze financial models for M&A transactions. The course covers essential topics including M&A transaction analysis, accounting, due diligence, deal structuring and financial modeling with focus on renewable energy projects. Advanced topics such as sizing debt financing, determining payment structures and carrying out investment return analysis are also covered in the course.

16 hours on-demand videos

180 downloadable resources

Financial Modeling For Mining Course

In Financial Modeling for Mining course, we will build project finance model for a gold open-pit project. The course is based on soft mini-perm debt structure with cash sweep provision and refinancing facility. Risk mitigation reserve accounts such as DSRA, MRA and Ramp-Up Cash Reserve are also included in the model. Finally, financial model will include mine decommissioning expense and decommissioning reserve fund.

14 hours on-demand video

170 downloadable resources

Project Finance Modeling For Infrastructure

In The Project Finance Modeling For Infrastructure course, we will model complex greenfield toll road project finance transactions from scratch in Excel.

Project finance models are used to assess the risk-reward of lending to and investing in an infrastructure project. The project’s debt capacity, valuation, and financial feasibility depend on expected future cash flows generated by the project itself and a financial model is built to analyze this.

10.5 hours on-demand video

165 downloadable resources

Accounting for Financial Modeling

Accounting for Financial Modeling will give you the skills to understand and analyze the financial statements of public and private companies. The course covers essential and advanced topics related to the income statement, balance sheet, and cash flow statement, and will provide you with a robust skillset for analysis of advanced accounting issues that appear often in real-world financial analysis. The focus is on the US GAAP accounting, however, whenever the US GAAP deviates from the IFRS accounting, the difference will be reviewed.

14 hours on-demand videos

150 downloadable resources

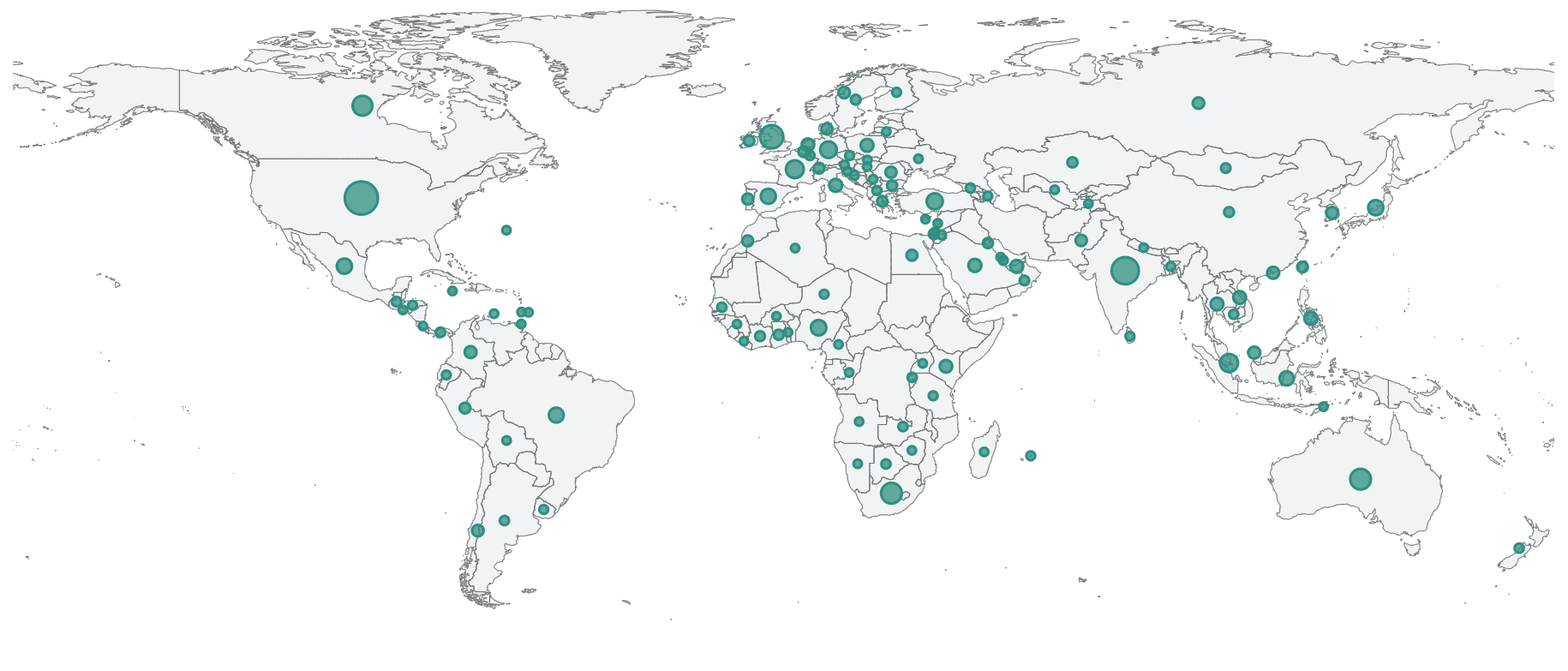

Online Project Finance Courses Trusted Worldwide

Course Features

- Lecture 0

- Quiz 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 118

- Assessments Yes