🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

(This course can be delivered immediately) The Renaissance Goldmine of Brilliant Tax Strategies For Real Estate Investors, Al Aiello Also, this tax course is tailored to business owners. This will result in even greater savings for you.

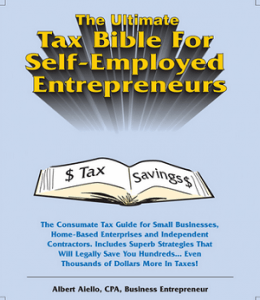

Al Aiello – The Ultimate Tax Bible For Self-Employed Entrepreneurs

How would you like to be a business owner?

- Your CPA may not be aware of hidden tax savings

- Protect yourself against IRS audits

- Avoid expensive advice that is not right and learn more.

You can do it with:

The Ultimate Tax Bible For

Self-Employed Entrepreneurs

______________________________________

Al AielloCPA, MS Taxation, Business Owner

As the author The Renaissance Goldmine of Brilliant Tax Strategies For Real Estate Investors, Al Aiello Also, this tax course is tailored to business owners. This will result in even greater savings for you.

All Self-Both at home and at work-Businesses that are based on real estate investors (or any other type of business) will be Profit This course will also cover all types entities: Schedule C partnerships, corporations, LLCs, and corporations.

A partial list of all the money-Saving gems you will find:

200+ Little-Known, Brilliant & Updated Tax Reduction Strategies These can all save you hundreds, thousands, or even 200!!

7 Proven Tax Tips You must be able to cut taxes forever.

How to deduct almost everything Everything You Pay With over 250 deductions, you will be a renowned accountant. Walking tax deduction!!

18 Ways To Audit Proof Your Business Returns You can let the IRS forget about you and your wallet. Avoid the aggravation, time and costs of an audit!!

The Right entity for Your Business This will allow you to save the most tax!

17 Ways to Write-Save $1,000 on Capital Assets – all in one year!

19 ways to maximize auto deductions to ”Drive” away your taxes!

Is it really better to lease an auto? What you should and what you shouldn’t do!

Take Vacations Off Your Credit Card! Let the IRS Pick up The Tab!

13 ways to deduct entertainment Profit & Have Fun Do It While You Do It!

To Generate Your Own Home, Use This Method Tax Savings So you can save while you sleep

How to safely claim your Home-Correctly Calculate Office Deductions These are not red flags.

9 Ways to Reduce Payroll Stress by Hiring Assistants

Family members are encouraged to use this feature To help your business grow and reduce your tax bill

All Medical Deductions can be deducted as business expenses.

36 Ways To Maximize Valuable business deductions

9 Ways to Create Wealth With Retirement Plans… Tax-Free!

Reduce them Killer Social Security Taxes Don’t let your income go to waste!

Lower Your Quarterlies Keep the interest alive!

Find Hidden Tax Dollars from the Past Let the IRS make you wealthy!

This book contains many tax gems that even the most experienced tax advisors don’t know about!

There’s more!

“This is a course you must have if you plan on being in business. The plain language explanation of these tax reduction strategies should be required reading for all self-employed entrepreneurs.”

Allan Domb is a top producing Realtor in Center City Philadelphia

The Tax Bible includes:

A Comprehensive 300 Page Updated On-Line Manual

- Tons of money-Save money – right in the pocket

- To document your strategies, complete tax law citations

- Many overlooked deductions can lead to more savings

- For ease of use, in an electronic downloadable format

UPDATEDAUDIO CD SERIES 10 Audio CDs with detailed Tracking

CD Collection 1:

Track 1 Start on the Right Foot

Track 2 Great Tax Advantages of a Business

Track 3 How to Maximize the Depreciation Deductions in your Business

Track 4: Huge Upfront Deductions for First-Year Expensing

Track 5: Other Depreciation Deduction Strategies that Save You More

CD Collection 2:

Track 1 Strategies to Maximize the Auto Depreciation

Track 2 Strategies with Auto Deduction Methods

Track 3 Standard Auto Mileage Method

Track 4: Actual Method of Deducting Automobile Expenses

Track 5: Strategies to Increase Business Mileage and Deductions

Track 6: Which is better, lease or buy?

CD Collection 3:

Track 1 Strategies to Maximize Entertainment

Track 2 Strategies to Maximize Your Output-Of-Town Travel

Track 3 Strategies to Maximize Your Home-Deductions for the Office

CD Collection 4:

Track 1 Independent Contractors: Save on Payroll Taxes

Track 2 Business expense: Deducting family members

Track 3 Fringe Benefits: More Family Deductions

Track 4: More Family Tax Strategies via Leasing

CD Collection 5:

Track 1 Types and Advantages to Retirement Plans

Track 2 Qualified (Keogh) Plans

Track 3 SIMPLE Plans and SEP Plans (best kept secret).

Track 4: Retirement Plan Strategies

Track 5: IRA’s – Traditional and Roth Plans

Track 6: How to Take Out Tax-Free Money from IRAs & Other Tips

CD Collection 6:

Track 1 Fully Deduct Business Tax Losses even with no income

Track 2 Strategies to Maximize Deductions in Business Schedules

Track 3 Auditing:-You can prove your business

Track 4: Audit-Proofing Statements

Track 5: Strategies and Advantages of Filing Extensions

CD Collection 7:

Track 1 Use an S-Corp can save on Social Security Taxes

Track 2 Use an S-Corp with a Medical Reimbursement Plan

Track 3 Other Tips to Lower Social Security Taxes

Track 4: Other S-Planning Tips for Corp

Track 5: C-Corporations – When and How to Use

Track 6: Use an LLC to Manage Your Business

CD Collection 8:

Track 1 Strategies for Loss-Years, including NOLs for refunds

Track 2 You can lower your quarterly estimates without imposing any penalties

Track 3 Securely File Amended Returns for Hidden Tax Dollars

Track 4: How to choose the right Tax Advisor for Your Business

CD Collection 9:

Track 1 Don’t Forget About Business Deductions (and Savings).

Track 2 Year-End Tax Planning Strategies (up until December 31)

Track 3 Why are you paying too much tax and what to do about it

CD Collection 10:

Real World Case Study In 7 simple steps, a business owner can save over $19,000 Her CPA didn’t even think of it!

TWO CD-ROM DISKS Reusable forms in Microsoft Word:

Disk 1: Bible Forms Disk – IRS Audit Proofing statements; Checklist of Overlooked deductions; Special Reports Tax-Saving Elections; IRS Penalty Killer Packet. These forms will not be available anywhere else.

The Independent Contractor’s Agreement Kit – Forms & Procedures to save you thousands in payroll taxes and time-Filings that are harmful to your health. You can also use other employment forms to protect yourself.

Disk 2: Kit for Medical Reimbursement – Forms & Procedures To deduct medical costs as business deductions and save thousands every year. Al’s students are saving $4,000 to $8,000 a year in taxes, just with this ONE easy-to-use strategy.

CUSTOMER SUPPORTLINE HELPLINE – 1 YEAR FREE For prompt money, email your tax questions to one our CPAs-Saving responses. “I am so impressed how quickly you respond. I am truly glad to be a student of yours!”

Melody ([email protected]

Praise for the “Bible”

“Even with all of my tax background as a CPA, I find The Tax Bible one of the best saving tax devices written in simple language for an ordinary person to understand. Everyone should have a copy on their research shelf…”

Al Brindisi CPA, MBA, Director for Graduate Tax Former IRS Trainer

“This is a must for every self-employed person. Not only is it loaded with useful tax saving techniques, but the schedules and checklists are wonderful time-savers and identify tax deductions which are frequently overlooked by professionals.”

Dennis L. Cohen Tax Attorney, Cozen and O’Connor, National Law Firm

“This far surpasses anything that I have learned before. It gave me specific tax reduction techniques that I applied immediately. I save a considerable amount of taxes every year because of Mr. Aiello’s insight”

David Freedman, CCIM Business Owner

“Al, your Tax Bible saved me almost $20,000 in taxes. You have a customer for life!”

Jim Brenneck, Self-Employed realtor

Sale Page : http://www.alaiello.com/business_owners.htm

Here’s what you can expect in the new book Al Aiello – The Ultimate Tax Bible For Self-Employed Entrepreneurs

Course Features

- Lecture 1

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 185

- Assessments Yes

- 1 Section

- 1 Lesson

- Lifetime

- Purchased: Al Aiello - The Ultimate Tax Bible For Self-Employed Entrepreneurs1