🌟 New Year Offer 🌟

Celebrate 2025 with 30% OFF on all products! Use code: NEWYEAR2025. Hurry, offer ends soon!

How To Become A Certified Commercial Real Estate Stabilized Transaction Specialist. Finally! You’ll Have a Step By Step Formula and System To Find, Acquire, Control, and Finance Stabilized Commercial Assets Stabilized The most sought-after and safest properties are…

ACPARE – Stabilized Transaction Mastery

- Retail

- Multifamily

- Office

- Industrial

And in today’s cynical market, it’s not enough to simply be an “investor.”

Investors are scarce. So what’s the solution?

As a Stabilized Transaction SpecialistYou will be different from every other investor in your market. You communicate to your prospects clearly that you understand their problems and can provide solutions.

As a certified specialist, you grab the lion’s share of deals, you attract the BEST clients, and you command much higher fees for your services and expertise. You are the expert and authority in your field when you specialize. That is how you attract capital, investors, and deals.

The cold, brutal truth of the matter is…

You just need the right training to become an investor, deal maker, intermediary, or stabilized asset expert.

And that’s exactly what you get in this Stabilized Transactions Master Class ACPARE Certification Program.

ACPARE – Association of Capital Placement Agents for Real Estate – is the country’s gold standard for commercial real estate investing training and education.

You’ll be uniquely qualified to help your clients identify great stabilized commercial opportunities (and avoid horrible deals), place capital, structure deals, and increase the value of their assets.

- Why stabilized properties are safer Most in-demand assets and investments In all aspects of commercial real property

- The 4 Asset Types and How to Use them Profit from each one Of them

- 4 Key Criteria to Consider When Choosing an Author Stabilized Assets…and why they’re so attractive to the big institutional investors (when you find a property with all of these, you’re golden)

- Which multifamily residential buildings are most popular? ‘easy money’ Consistent returns

- The SINGLE BEST stabilized property to invest in (it’s not what you’d expect!)

- The 3 Classes of office buildings…and what institutional investors WANT most

- How to 3 lucrative INCOME STREAMES on a single deal…and pocket a fortune

- The #1 Secret to Removing Risk Getting the deal signed, sealed and delivered is the last step in the equation.

- How to use the 8.-Point Checklist to get your investors to come knocking on your door to complete the deal

- Which capital providers to bring to the table for each type of deal (you’re going to love this)

- How to EASILY structure permanent financing for your deals…and minimize risk

- Raise capital for ANY stabilized asset…no matter where you live

- Where to find permanent financing…and how to Get them to fund your deal by asking for money

- How to analyze a property in 90 seconds…deal or no deal?

- The 3 Essential Elements for a stabilized NOI…and feel totally confident the deal makes sense

- Two Lease Types and How to Use Each to Your Advantage

- How to Instantly find out if your sponsor is paying too much This simple formula can be used to get in on a strong base or purchase a property.

- How to approach institutional and equity investors to get their attention?

- How to use it Simple “safety metric” As a benchmark for a secure loan (crucial for any lender).

- Your investors will love the underwriting guidelines that make them feel secure and warm.

- The pros and cons of each asset class…what properties to acquire and what to avoid like the plague

- The most ATTRACTIVE commercial asset class to investors…and the safest

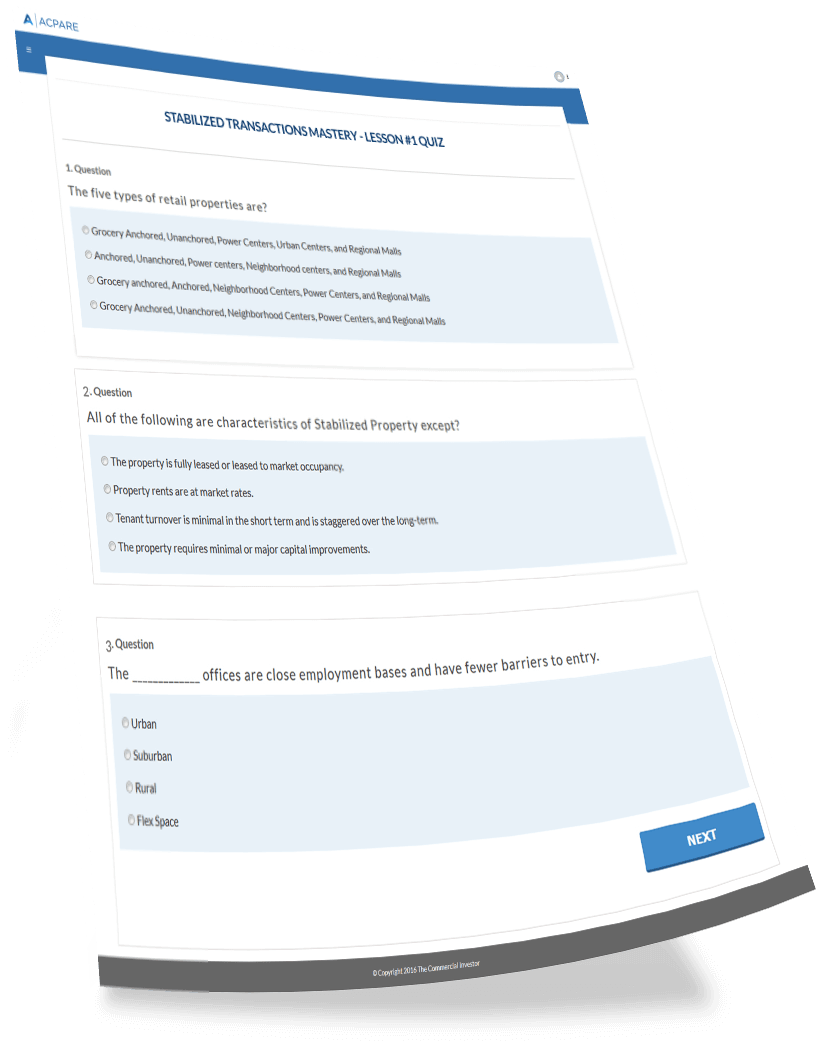

Stabilized Transaction Mastery Certification! The exams are designed to help you succeed. They’re not “tricky” (no SAT goofiness)… yet they do test your knowledge and comprehension of the material. 80 is the passing mark. You can take the exam three times. If you don’t pass after 3 attempts, simply go back through the module prior to taking the test again.

The exams do not have a time limit. They include 60 multiple-choice and true/false question. Allow 45-The exam takes approximately 60 minutes. The exam can be completed in one sitting. If you need to complete the exam later, you can save your answers.

Upon successful completion of the course and exams, you’ll receive a personalized certificate and badge.

Display your badge on the website, in your email signature and community portals.

AND…your digital certificate is full color, so print it up, frame it, and display it proudly in your home and office.

- The Stabilized Transaction Mastery Course

- 12 Core Lessons

- 36 Modules

- 15 Handouts

- 12 Review Quizzes

- A Wall Street grade ACPARE Badge designating you as a Certified Stabilized Transaction A specialist that you can display on your website and email signature.

- A digital printable ACPARE Certificate Frames

- Status and recognition As a Certified Stabilized Transaction Specialist

Level: Intermediate / Advanced

Setting: Online / Virtual

Course Length: 8 hours

Expected completion date: 3-7 Days

Course Features

- Lectures 0

- Quizzes 0

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 0

- Assessments Yes