🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

You’ll see how to set up your trades … create your best “edges” for success … adjust and manage your position … and much more.File size: 332.3 NB

Tradingconceptsinc – Calendar Spreads

Make 10-15% Return on your Invested Capital in as Short as 2 Days – Trading the Reliable “Pauses” Find them in stocks and ETFs

Contrary to what you might think after reading the above statement, this invitation isn’t for the trader hunting for the Holy Grail …

The fast lane to quick riches … or the single, life-changing return …

It’s for the rest of us.

It’s for the trader willing to set aside greed and undue risk for consistent profits. One who just wants more income to supplement their current income or for future retirement.

It’s for the trader who would benefit from even just an extra $150 a week.

You see, that’s the first objective for the OptionsMD Calendar Spread Strategy …

You can make a quick $100-$150 contract per week – every single week.

Although it may not seem like much, it is. But imagine adding a few more contracts each week after you master the strategy (which, as you’ll soon see, only takes about three hours).

Your profits would increase quickly and there is minimal risk.

You can make extra income by learning this strategy quickly.

But before digging into the details, let’s address a common concern …

Why would you need a different trading strategy?

Iron Condors are so popular, why not continue to use them?

This approach seems rational. However, look close at today’s market and you see a couple problems.

The first is velocity. Today’s price movement doesn’t lend well to being in nondirectional trades for weeks at a time – as is necessary with Iron Condors.

Additionally, volatility can cause a shortage of premium to buy, making your Iron Condor wings very dangerously close.

During the last decade trading Iron Condors, the only time I’ve seen these same conditions is in 2007. As it was in 2007, you must always be on guard against big moves.

Iron Condors remain an option when the right conditions exist. But just understand that trading in today’s market means you take on much more risk unless you also have the right implied volatility levels.

To reap the benefits All Smart traders are able to use multiple strategies to diversify and smoothen the market.

The fact is …

The OptionsMD Calendar Spread Strategy This allows you to generate the exact same return in just days, as opposed to weeks.

As a trader, you live or die on your “edge” – whether it’s discipline, a specific routine, lack of emotional trading or a proven strategy.

When I created this strategy, my goal was to establish your edge. It was easy enough to put into practice for anyone.

So, we will only be focusing our attention on these two items:

- Price

- Options volatilities

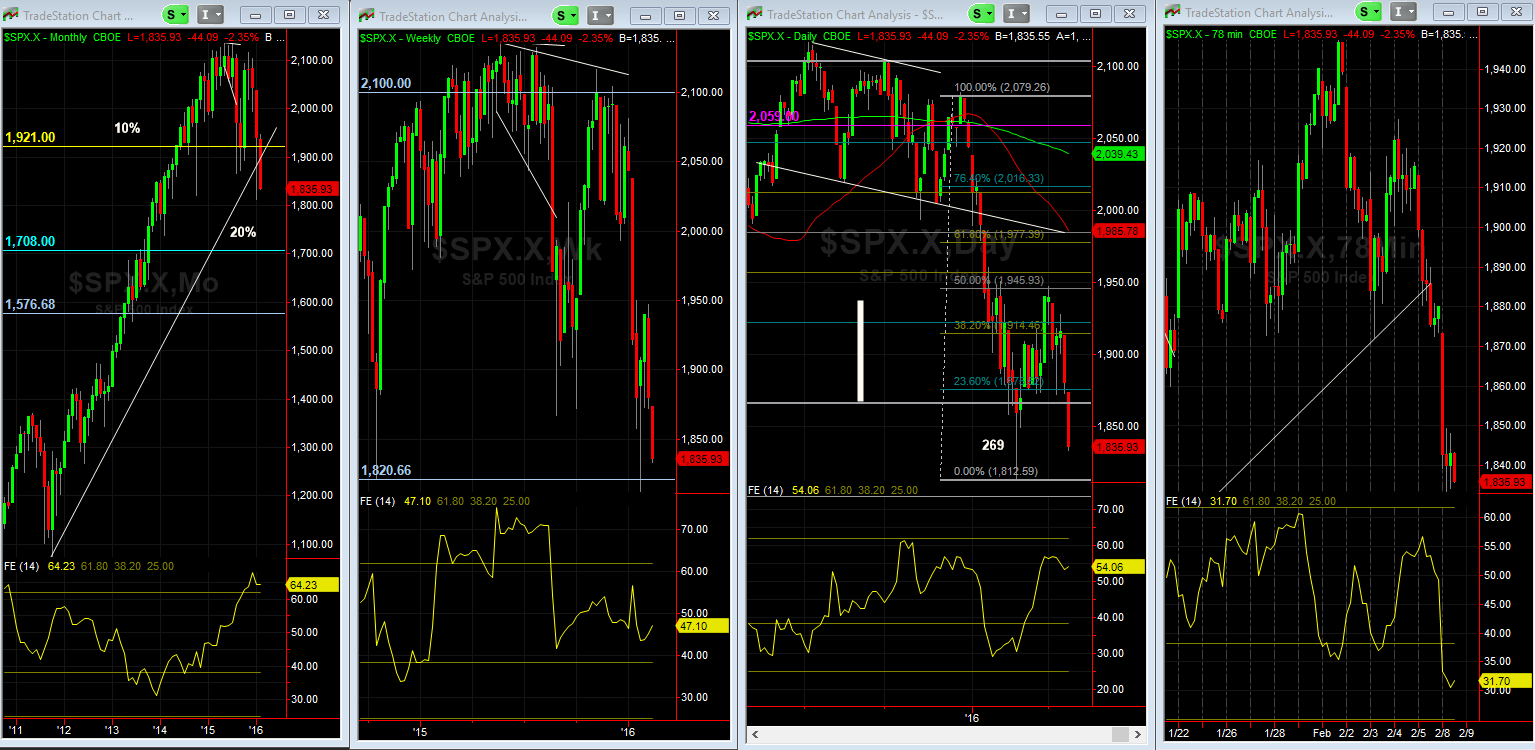

First, we simply look for a time in a price chart where there’s a high probability of consolidation for a few days – or least a slowing trend.

(HINT – These situations are common after range expansion. I’ll show you how to pinpoint exactly where the market is likely to pause and catch its breath.)

A calendar spread allows you to buy and sell the exact same type of option at the same strike price, but at different expiration dates.

Here’s an example of how we put this together:

For a couple of days, it’s not too bad, right?

And that’s just one contract …

My point is, if you only traded one strategy in today’s market, you could make a pretty good income with the OptionsMD Calendar Spread Strategy.

And something else to remember …

Trading this strategy isn’t slow. You’re in and out of trades often in two days.

So it’s exciting and fun.

Let me show you some other results …

Here’s a list of several calendar spread trades I made and recommend in my IncomeRx newsletter.

Notice how I trades – using OptionsMD Calendar Spread Strategy – were profitable in 87.5% percent of the time.

In fact, for every $1 that I lose, I make an average $19.80.

Would you make this tradeoff for it?

Yes!

Listen, this is a strategy built to be robust enough to pull consistent profits from today’s market.

However, I must emphasize that the OptionsMD Calendar Spread Strategy Because of the way I created the edges, and managed risk, it only seems easy.

At this point, you might feel confident that you can start trading the strategy right away. If you do, I appreciate your confidence.

I must stress, though … you need to learn the details, which is why I developed the training.

And that brings me to another point …

This strategy can be used on individual stocks or ETFs. However, I prefer ETFs as individual stocks are susceptible to earnings dates, management changes, and other similar events. So moving to ETFs/Indices lowers my risk.

No need to get greedy or complicate matters …

The way I teach this strategy is you stay in a trade for a limited time (often just a couple days) – enough to get your fair share of profit – then you move on …

You can make the same type or multiple trades every single week, depending on market conditions.

The fair share you can expect from each trade in this market is approximately 10% return on your capital. This strategy was created by me.

You might make more depending on the market.

Another good news is that you can only lose 15% of your capital if you follow the strategy.

You don’t have to do the math to see the odds are very much in your favor, especially when you consider the nearly 88% success rate I mentioned earlier.

And to ensure you never risk too much …

You don’t use more than 1-Trades should not exceed 2% of your total capital. This reduces your risk and ensures that you are not too emotionally attached to your results.

Remember what I said at my beginning?

The first goal of the organization is to make a quick $100-$150 per contract each week. OptionsMD Calendar Spread Strategy.

This strategy allows you to grow your wealth safely without feeling like you’re stuck in front of computer watching charts.

Here’s What to Do Next …

When you register today for just $397 ($297 for Trading Concepts members), I’ll give you instant access to the OptionsMD Calendar Spread Strategyvideo course. During the 3-hour training, we’ll dig deep into how the trades work.

You’ll see how to set up your trades … create your best “edges” for success … adjust and manage your position … and much more.

Furthermore, I don’t bog you down with Options greeks to figure out. To make your learning process even more simple, I share a number of proprietary tracking and analysis tools.

Remember the IncomeRx newsletter, which I mentioned earlier.

Get 1 for free-You can view me setup and manage my trades with the month subscription OptionsMD Calendar Spread Strategy.

Your 3-Hour video includes slides for each session, additional program materials, and an instructional DVD sent to your door. Also, lifetime updates are free.

And that’s not all …

You see, I’ve mentored thousands of traders, and I know with absolute confidence that my material works. In fact, I’m so sure it’ll deliver consistent profits for you that you can try it all for the next 30 days at no risk.

Watch the training videos … review the printed materials … test the strategy … study the slides …. go through the entire training as many times as you want …

If at any time during the next month, you don’t believe the training is worth at least 10 times your investment, simply send me a note and I’ll rush you a 100% refund.

No questions asked.

How’s that for fair?

My guarantee is a proof of my confidence in transforming your financial future.

The following system is recommended: OptionsMD Calendar Spread Strategy today.

Remember, even if you feel that you have made the right decision to go ahead with the trial, it is still your decision whether or not. OptionsMD Calendar Spread Strategy wasn’t worthy or profitable, you’ll get every dime back.

I think you’ll agree … I can’t be much fairer than that.

Give the OptionsMD Calendar Spread Strategy Give it a go today.

Download immediately Tradingconceptsinc – Calendar Spreads Get it now

Tradingconceptsinc – Calendar Spreads: Sample

Here’s what you’ll get in Tradingconceptsinc – Calendar Spreads

Course Features

- Lecture 1

- Quiz 0

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 143

- Assessments Yes

- 1 Section

- 1 Lesson

- Lifetime

- Purchased: Tradingconceptsinc - Calendar Spreads1