🌟 New Year Offer 🌟

Celebrate 2026 with 30% OFF on all products! Use code: NEWYEAR2026. Hurry, offer ends soon!

Stop guessing the market—start reading its intent.

The Order Flow Summer Trading Program teaches you to decode volume, order flow, and institutional footprints so you can trade with clarity, confidence, and a true professional edge.

(OrderFlows) Mike Valtos – 10 Weeks Summer Program 2025

Stop reacting to price. Start understanding intent.

The Order Flow Summer Trading Program is a high-level trading education experience built for traders who want to truly understand what’s happening beneath the candles. Instead of relying on lagging indicators or surface-level price action, this program teaches you how to read order flow, volume, and institutional footprints to anticipate market movement with confidence.

Delivered through 15 live, in-depth sessions, this program goes far beyond theory. You’ll learn how to interpret the hidden mechanics of supply and demand, recognize professional participation, and align your trades with the forces that actually move the market.

Who This Program Is Designed For

This training is structured to meet traders at multiple skill levels:

Beginner traders who want to build a strong foundation in order flow from day one

Intermediate traders who understand the basics but want deeper, more precise analysis

Advanced traders looking to refine their edge with proprietary, rarely taught techniques

Traders frustrated by inconsistency and seeking a structured framework for market behavior

Anyone ready to stop guessing and start making data-driven, confident trading decisions

No matter your experience level, the program focuses on clarity, structure, and repeatable decision-making.

What You’ll Master Inside the Program

Throughout the live sessions, you’ll gain advanced skills that transform how you read the market:

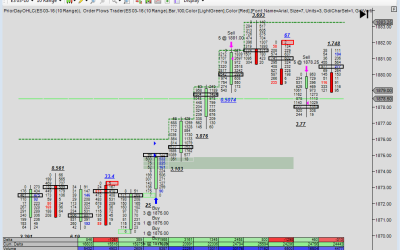

Staircase Volume Structures

Learn how to identify powerful “staircase” volume formations that often precede breakouts and trend continuation. These patterns reveal when momentum is being built quietly before explosive moves.

Stop-Loss Targeting Through Footprints

Understand how large participants engineer moves to trigger clustered stop-loss orders. You’ll learn how to recognize these behaviors in footprint charts and position yourself alongside smart money instead of against it.

Shadow Print Detection

Develop the ability to see what most traders miss. Shadow prints expose subtle institutional activity that leaves clues long before price reacts.

Volume Tipping Points

Master the skill of spotting critical moments when control shifts between buyers and sellers. These tipping points allow for earlier, more precise entries with defined risk.

The Proprietary Footprint DNA Strategy

This signature methodology teaches you how to break down order flow at a granular level to reveal the market’s true intentions—not just what price appears to be doing.

Delta Compression & Exhaustion

Learn how to identify when trends are losing strength and reversals are forming by reading delta behavior and participation imbalance.

Emotional vs. Algorithmic Behavior

Gain a significant edge by distinguishing between emotional retail-driven activity and structured algorithmic execution. Knowing who controls the market changes how you trade it.

Live Integration & Real-Time Market Execution

The final phase of the program brings everything together through live market analysis. You’ll apply each concept in real time, watching how order flow, volume, and footprints interact as the market unfolds.

This integration phase is where theory becomes instinct. You’ll learn how to:

Analyze live conditions with confidence

Filter noise and focus on meaningful data

Execute trades with logic instead of emotion

Why This Program Stands Out

Most trading education stops at patterns or indicators. This program trains you to read market behavior at its source. By focusing on order flow and institutional footprints, you develop a durable edge that adapts across market conditions.

The live-session format ensures depth, clarity, and immediate application—making this an ideal program for traders serious about professional-level analysis and execution.

If your goal is to understand the market rather than react to it, the Order Flow Summer Trading Program delivers the skills, structure, and insight to make that shift permanent.

Course Features

- Lecture 0

- Quiz 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 77

- Assessments Yes